Affordability Checks in Gambling

Ah, gambling! The thrilling rush of placing a bet, the anticipation of a win, and the occasional heart-stopping moment when the odds seem to be stacked against you. But as the world of gambling evolves, so too do the regulations that govern it. Enter the concept of affordability checks—your new best friend or worst nightmare, depending on how you look at it. Let’s dive into the nitty-gritty of affordability checks in the gambling realm, shall we?

What Are Affordability Checks?

At its core, affordability checks are measures designed to ensure that individuals are not betting beyond their means. Think of it as that well-meaning friend who stops you from ordering that third slice of cake when you’ve clearly had enough. These checks aim to assess a gambler's financial situation and prevent potential financial harm.

Why Are They Important?

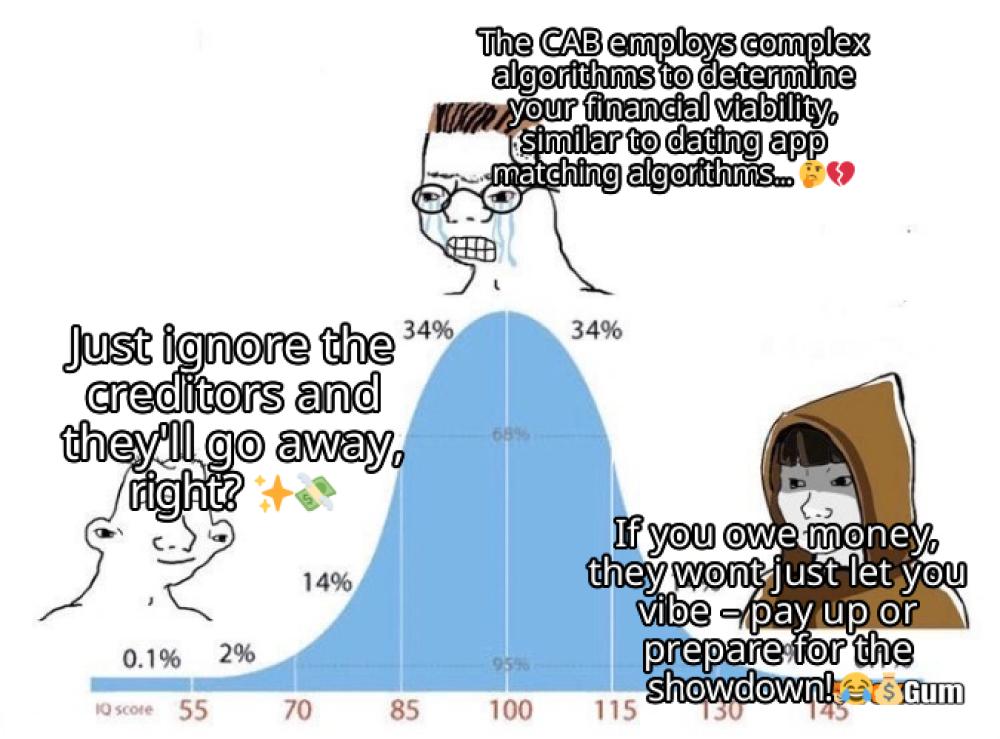

With rising concerns about gambling-related harm, particularly among vulnerable individuals, affordability checks are being introduced to create a safer gambling environment. The Gambling Commission in the UK has proposed two tiers of checks: one focusing on financial vulnerability and the other on enhanced checks for those deemed at higher risk. It's like a safety net, but with fewer holes—hopefully!

How Do They Work?

When you sign up with a gambling operator, you may be asked to provide some financial information. This can include details about your income, expenses, and even your spending habits. If you’re not comfortable sharing this information, it’s a bit like trying to enter a club without showing your ID—good luck getting in!

Types of Checks

- Basic Checks: These checks assess general financial information to ensure that you’re not betting more than you can afford. It’s like a friendly nudge to keep your gambling in check.

- Enhanced Checks: For those who may be identified as vulnerable, enhanced checks dig deeper. This could involve more detailed inquiries into your finances, ensuring that you’re not spiraling into a gambling abyss.

What Happens If You Don’t Pass?

If you fail an affordability check, the consequences can vary. You might be restricted from placing further bets until you provide more information or even be barred from the platform altogether. It’s a bit like being grounded for sneaking out—no fun at all!

Controversy Surrounding Affordability Checks

As with any regulation, there’s a fair amount of debate surrounding affordability checks. Some argue that they infringe on personal privacy, while others believe they are a necessary step towards responsible gambling. It’s a classic case of “you can’t please everyone,” but the hope is that these checks will ultimately lead to a safer gambling landscape.

Conclusion

Affordability checks are here to stay, whether we like it or not. They aim to protect individuals from financial harm while promoting responsible gambling practices. So, the next time you’re tempted to place that bet, remember: it’s all about keeping it fun, safe, and within your means. After all, there’s no jackpot worth risking your financial future over! 🎰

All About the Encyclopedia Britannica: Your Go-To Source for Knowledge!

All About the Encyclopedia Britannica: Your Go-To Source for Knowledge!

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics