The Health Care Sharing Ministry Tax Parity Act

In a world where healthcare costs continue to rise, many Americans are seeking alternative solutions to manage their medical expenses. One such alternative is the Health Care Sharing Ministry (HCSM), which allows members to share their healthcare costs based on shared values and beliefs. Recently, Congressman Mike Kelly introduced the Health Care Sharing Ministry Tax Parity Act, a legislative effort aimed at leveling the playing field for those who choose this path. Let’s dive into what this act entails and why it matters.

What is the Health Care Sharing Ministry Tax Parity Act?

The Health Care Sharing Ministry Tax Parity Act, designated as H.R. 8776, seeks to eliminate the disparity in tax benefits between traditional health insurance and health care sharing ministries. Currently, individuals with traditional health insurance can deduct their premiums from their taxable income, but members of HCSMs do not enjoy the same benefit. This act aims to correct that imbalance, offering members the same tax advantages as those with conventional health insurance.

Why is This Legislation Important?

For many, HCSMs offer a viable alternative to conventional health insurance, particularly for those who prefer a faith-based approach to managing healthcare costs. Members of these ministries often share over $1 billion in medical expenses annually. By introducing tax parity, Congressman Kelly hopes to support the millions who rely on these communities for their healthcare needs. Here are a few key reasons why this legislation is significant:

- Promotes Fairness: By allowing tax deductions for HCSM members, the act promotes fairness in the healthcare landscape, ensuring that all individuals have access to similar financial benefits.

- Encourages Participation: With the potential for tax savings, more people may consider joining HCSMs, which could lead to a stronger community and more shared resources.

- Supports Alternative Healthcare Solutions: As healthcare costs soar, it’s essential to recognize and support alternative solutions that work for different populations.

- Enhances Financial Freedom: This act could provide members with more financial flexibility, allowing them to allocate funds toward other essential needs.

Community Response

Reactions to the introduction of the Health Care Sharing Ministry Tax Parity Act have been largely positive among those involved in the HCSM community. Organizations like Solidarity HealthShare have expressed gratitude for Congressman Kelly’s commitment to ensuring that individuals who choose faith-based healthcare solutions are treated equitably. This legislation not only acknowledges the unique needs of HCSM members but also reinforces the importance of community and shared values in healthcare.

Looking Ahead

As this legislation moves through Congress, it will be interesting to see how it evolves and the impact it may have on the healthcare landscape. The Health Care Sharing Ministry Tax Parity Act represents a step toward recognizing the diverse ways in which Americans approach their health and wellness. By fostering an environment where all healthcare options are respected and supported, we can work towards a more inclusive healthcare system.

In conclusion, the Health Care Sharing Ministry Tax Parity Act is a significant development for those who rely on health care sharing ministries. It’s a reminder that healthcare should be accessible and equitable for everyone, regardless of the path they choose. 🌟

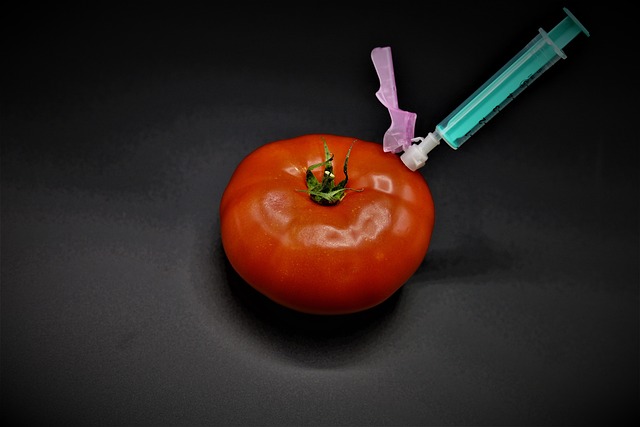

Genetic Variation Within a Population

Genetic Variation Within a Population

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics