IRS Transcripts

When dealing with taxes, it's essential to understand the various documents that may be required for different purposes. One such document is the IRS transcript. This article will provide a comprehensive overview of what IRS transcripts are, the types available, and how to obtain them.

What is an IRS Transcript?

An IRS transcript is a summary of your tax return information. It includes key details such as your filing status, adjusted gross income, and taxable income. Unlike a full tax return, which contains all the line-by-line details, a transcript provides a more concise view of your tax data.

Types of IRS Transcripts

The IRS offers several types of transcripts, each serving different purposes:

- Tax Return Transcript: This type includes most line items from your tax return, along with any accompanying forms and schedules. It is often used for verifying income when applying for loans or financial aid.

- Tax Account Transcript: This transcript provides basic data such as your filing status, taxable income, and any adjustments made after you filed your return. It is useful for understanding changes to your account.

- Record of Account Transcript: This combines both the tax return and tax account transcripts, offering a comprehensive view of your tax history.

- Wage and Income Transcript: This document shows data reported to the IRS by third parties, such as employers. It can be helpful if you need to reconstruct your income for a specific year.

- Verification of Non-filing Letter: This is not a transcript per se but is a document issued by the IRS confirming that you did not file a return for a specific year. It's often required for financial aid applications.

How to Obtain an IRS Transcript

Getting an IRS transcript is a straightforward process. Here are the steps to follow:

- Online Request: The quickest way to obtain a transcript is through the IRS website. You can use the “Get Transcript” tool, where you will need to provide personal information, including your Social Security number, date of birth, and filing status.

- By Mail: If you prefer, you can request a transcript by mailing Form 4506-T to the IRS. This form allows you to specify the type of transcript you need and the years for which you require it.

- By Phone: You can also call the IRS at 1-800-908-9946 to request a transcript. Be prepared to provide your personal information for verification.

Important Considerations

When requesting an IRS transcript, keep in mind the following:

- Free of Charge: Transcripts are provided at no cost, which makes them a convenient option for obtaining necessary tax information.

- Timeframe: If you request a transcript online, you may receive it immediately. However, mail requests can take several days to process.

- Privacy Protection: Transcripts are designed to protect your personal information. Sensitive data is partially masked to prevent unauthorized access.

Conclusion

Understanding IRS transcripts is crucial for anyone dealing with tax matters, whether for personal use, loan applications, or financial aid. By knowing the types of transcripts available and how to obtain them, individuals can ensure they have the necessary documentation to support their financial activities.

Regulatory Charges by DHL

Regulatory Charges by DHL

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

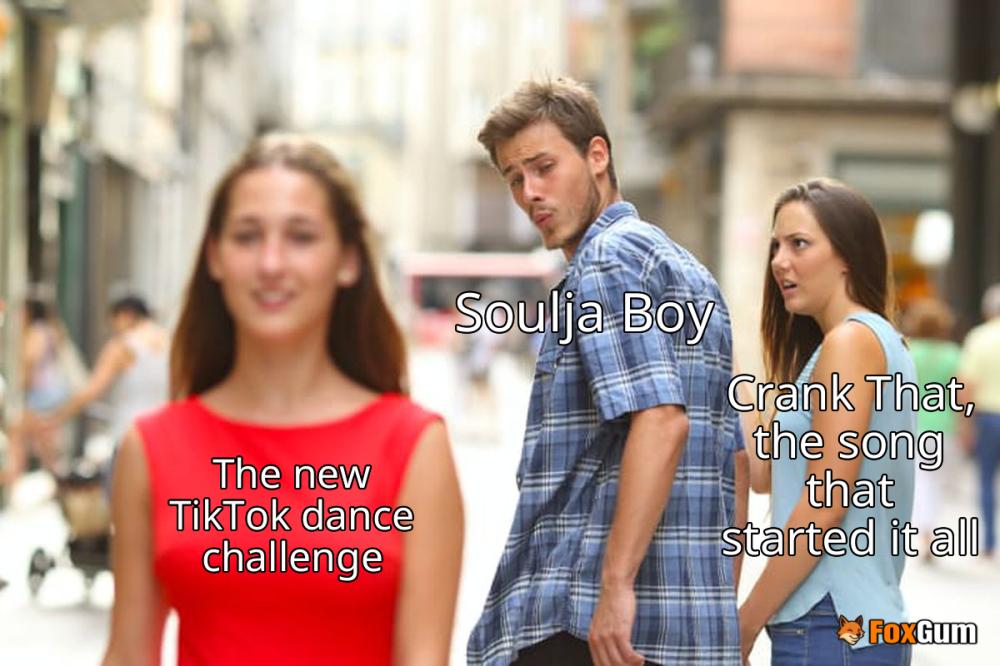

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics