The SAVE Plan: A New Hope for Student Loan Borrowers

In the ever-tumultuous world of student loans, the Saving for a Valuable Education (SAVE) plan emerged like a knight in shining armor—or maybe more like a knight in slightly tarnished armor, considering the recent legal hiccups. Designed to offer a more manageable income-driven repayment option, the SAVE plan has become a beacon of hope for many borrowers. But just like a good Netflix series, it’s not without its cliffhangers.

What is the SAVE Plan?

The SAVE plan was introduced by the Biden administration in 2023, aiming to simplify the repayment process for borrowers. Think of it as the student loan equivalent of a cozy blanket on a cold day. It was supposed to provide an easier path toward loan forgiveness for those who qualify. However, as with all good things, there’s a catch—or two.

Current Issues: Lawsuits and Forbearance

Despite its noble intentions, the SAVE plan has been caught in a web of ongoing lawsuits that have thrown a wrench in the gears. Borrowers, like 55-year-old Tammy Stinson from Iowa, found themselves just one payment away from forgiveness when the plan was paused. It’s like being at the finish line of a marathon only to discover that the race has been put on hold due to a sudden downpour. Talk about frustrating!

As of June 2024, a court placed an injunction on the plan, preventing the Department of Education from rolling it out as intended. This legal drama has left around 8 million borrowers scrambling for alternatives. Many are fleeing the SAVE plan, seeking to continue their progress toward forgiveness, while others are left wondering what their next move should be.

How to Navigate Your Options

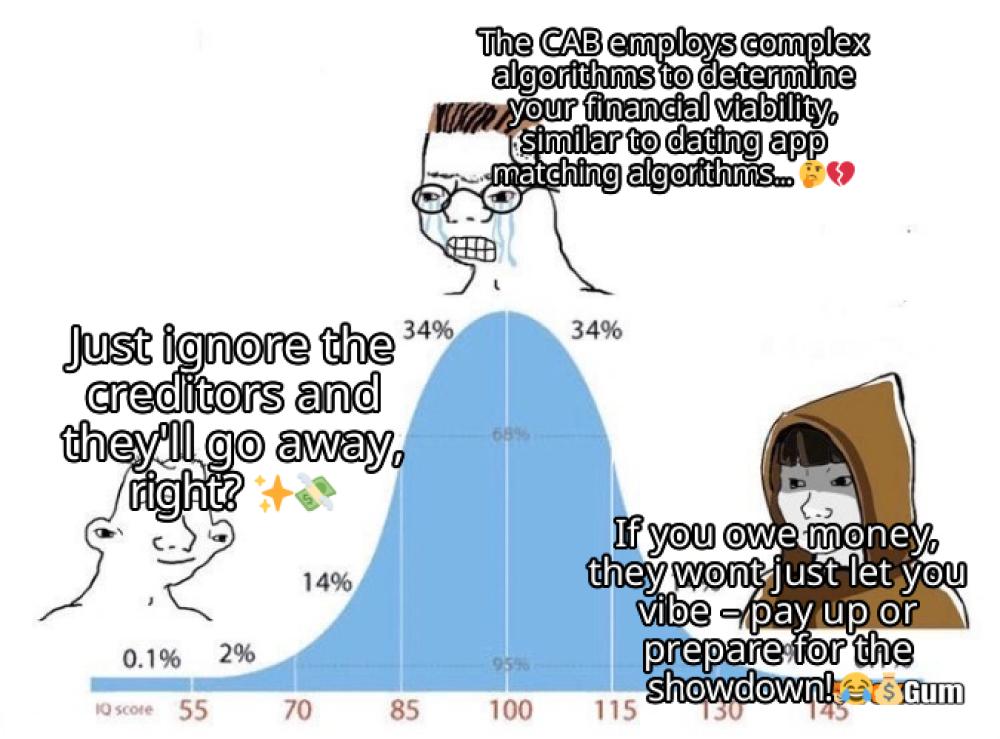

So, what should borrowers do in the face of this uncertainty? Here’s a practical guide:

- Stay Informed: Keep an eye on updates regarding the SAVE plan and any ongoing legal changes. Knowledge is power, and in this case, it could save you from a financial headache.

- Consider Other Repayment Plans: If the SAVE plan isn’t working out, explore other income-driven repayment options. There are multiple paths to forgiveness, and one might just fit your needs better.

- Document Everything: Keep records of your payments and correspondence with loan servicers. This will come in handy if you need to prove your progress toward forgiveness.

- Consult a Financial Advisor: Sometimes, a little professional guidance can go a long way. They can help you navigate the murky waters of student loans.

Final Thoughts

The SAVE plan was meant to be a game-changer for student loan borrowers, but legal issues have turned it into a bit of a rollercoaster ride. While it’s easy to feel overwhelmed, remember that you’re not alone in this. Many borrowers are in the same boat, and there are options available to help you stay afloat. So, grab your metaphorical life vest, and let’s navigate these choppy waters together. After all, the goal is to reach the promised land of loan forgiveness—preferably without needing a lifeguard!

Globalization and Its Discontents

Globalization and Its Discontents

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics