Saving Smarter: Your Wallet Will Thank You

Let’s face it: saving money isn’t the most thrilling topic on the planet. It's like watching paint dry, but with fewer colors and more anxiety. However, if you want to avoid living in your parents' basement forever, it's time to get serious about saving smarter. Here’s a guide that’ll help you keep your bank account happy while also keeping your sanity intact.

1. Know Your Net Income

First things first, let’s talk about net income. This is the amount that actually hits your bank account after the taxman has had his share. Think of it as your financial reality check—like a cold splash of water in the face when you realize how much you *actually* have to work with. Knowing this number is crucial for budgeting. If you don’t know what you’re working with, you might as well be throwing darts blindfolded.

2. Pay Yourself First

Before you start paying bills, buying groceries, or treating yourself to a new pair of shoes (sorry, Cole Haan, you’ll have to wait), make sure to set aside a portion of your income for savings. This is like putting on your oxygen mask before helping others. Save first, then spend. It’s a simple rule that can make a world of difference. Aim for at least 20% of your paycheck. Your future self will thank you.

3. Simplify Debt with Balance Transfers

If you’re drowning in high-interest debt, consider a balance transfer to a credit card with a lower rate. It’s like moving from a crowded subway car to a spacious first-class cabin. With a UMe Visa Credit Card, for example, you can consolidate your debt without hidden fees. This way, you can focus on saving rather than just making minimum payments. Who doesn’t want to be a financial wizard?

4. Explore High-Yield Savings Accounts

Now that you’re saving like a pro, let’s talk about where to park that money. Traditional savings accounts are about as exciting as a beige wall. Instead, look for high-yield savings accounts that offer better interest rates. Your money should work as hard as you do. It’s like giving your savings a gym membership—watch them bulk up while you sit back and sip your coffee.

5. Set Realistic Goals

When it comes to saving, setting goals is essential. But remember, Rome wasn’t built in a day, and neither will your financial empire. Start with short-term goals—maybe a vacation or a new gadget—and then work your way up to bigger dreams like a house or retirement. Break it down into manageable chunks. You wouldn’t run a marathon without training first, right?

6. Keep Track of Your Spending

Finally, keep an eye on where your money goes. Use budgeting apps or just good old-fashioned spreadsheets to track your spending. It’s like having a personal trainer for your finances. You can’t improve what you don’t measure. Plus, you’ll be less likely to splurge on that third coffee of the day when you see how it adds up. ☕

In conclusion, saving smarter isn’t rocket science, but it does require a bit of discipline and foresight. By knowing your net income, paying yourself first, simplifying your debt, exploring high-yield savings, setting realistic goals, and tracking your spending, you’ll be on your way to financial freedom. Now go forth and save like a boss!

Survivor Builds in Dead by Daylight: Get Your Game Face On! 🎮👻

Survivor Builds in Dead by Daylight: Get Your Game Face On! 🎮👻

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

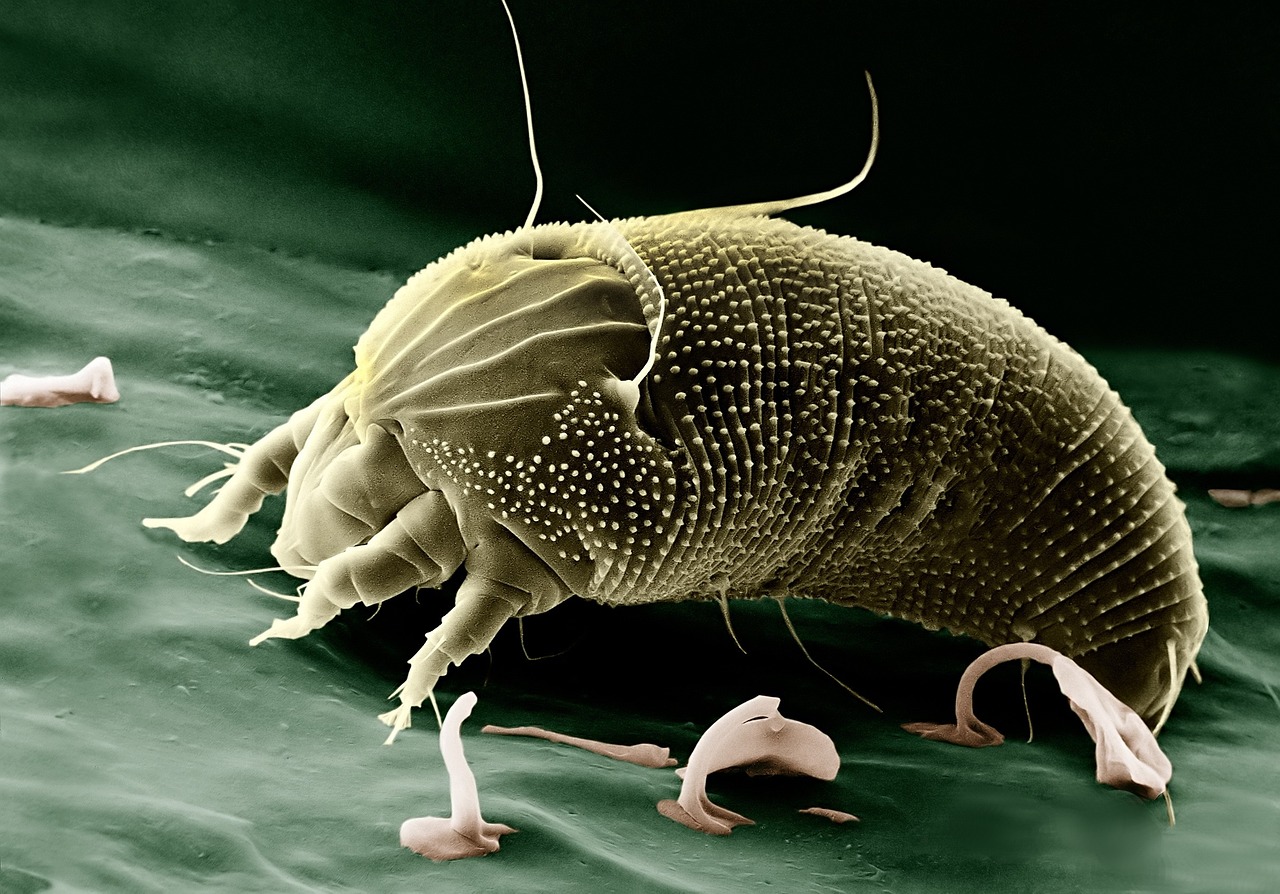

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics