The Tax Rules for Selling Your Primary Residence

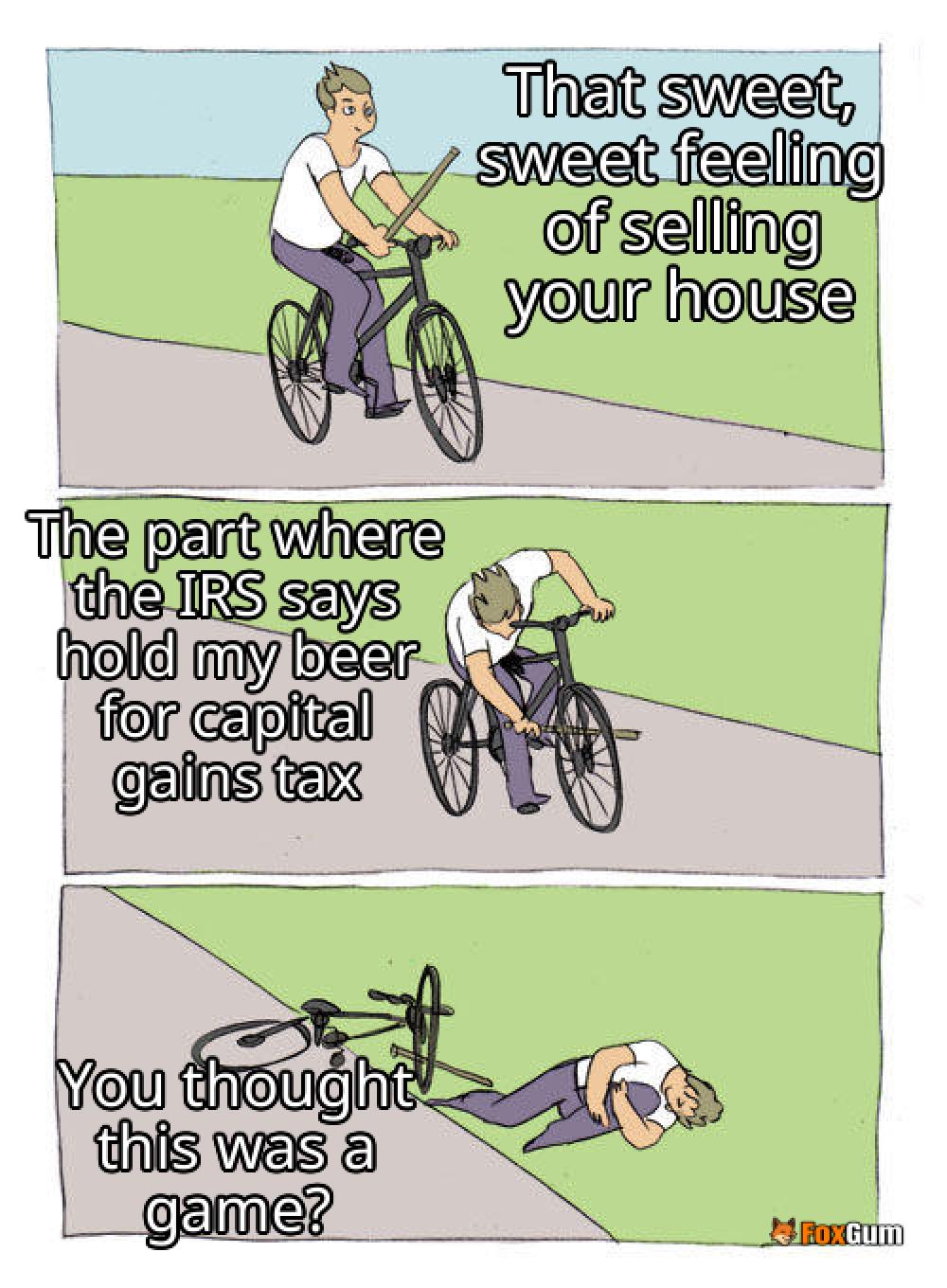

So, you’ve finally decided to sell your home and move on to greener pastures (or maybe just a bigger TV). But hold up! Before you slap that “For Sale” sign in the yard, let’s break down the tax rules that could have you feeling like a financial superhero or a total sidekick. 🦸♂️

Capital Gains Exclusion: Your New Best Friend

Here’s the deal: if you sell your primary residence, you might be able to exclude a hefty chunk of change from your taxable income. We’re talking up to $250,000 for single filers and a whopping $500,000 if you’re filing jointly with your spouse. 💰 Yeah, you heard that right! This is like finding a $20 bill in your winter coat, but way better.

Eligibility Criteria

Now, don’t get too excited just yet. You’ve got to meet some criteria to qualify for this sweet tax break:

- Ownership Test: You must have owned the home for at least two of the last five years. So, if you bought it last week, sorry buddy, you’re out of luck.

- Use Test: The home must be your primary residence for at least two years during that same five-year period. No, you can’t count that time you “lived” in your buddy’s basement while binge-watching Netflix.

- Frequency: You can only claim this exclusion once every two years. If you’re flipping houses like pancakes, you’ll need to pay the piper on those gains.

Installment Sales: A Different Game

What if you sold your house under a contract that allows for payments over time? Welcome to the world of installment sales! 🏡💸 This means you might not pay all your taxes in one go. Instead, you’ll report the gain as you receive payments. It’s like a Netflix subscription for your tax bill—paying monthly instead of all at once!

Special Circumstances

Life happens, and sometimes you might find yourself selling under special circumstances. If you had to sell your home due to a job change, health issues, or other unforeseen events, you might still qualify for a partial exclusion. It’s like a safety net for life’s curveballs. 🎢

Final Thoughts

Before you start packing those boxes and dreaming of your new digs, make sure you’ve got a handle on these tax rules. It might just save you a boatload of cash! And remember, consult a tax pro if you’re feeling lost in the tax jungle. They’re like the GPS for your financial journey—minus the annoying voice telling you to “recalculate.” 😜

Rental Repairs and Maintenance Tax Deductions

Rental Repairs and Maintenance Tax Deductions

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics