The Traditional IRA

The Traditional Individual Retirement Account (IRA) serves as a fundamental tool for retirement savings, offering individuals a means to accumulate funds while enjoying certain tax advantages. This article aims to elucidate the key features, benefits, and considerations associated with Traditional IRAs, enabling individuals to make informed decisions regarding their retirement planning.

What is a Traditional IRA?

A Traditional IRA is a retirement savings account that allows individuals to contribute pre-tax or after-tax dollars. The primary advantage of this account type is the tax deferral on investment earnings. Generally, amounts within a Traditional IRA, including earnings and gains, are not taxed until distributions are taken. This feature can significantly enhance the growth potential of retirement savings, as the funds can compound without the immediate burden of taxation.

Tax Advantages

One of the most compelling reasons to consider a Traditional IRA is the tax benefits it offers. Contributions made to a Traditional IRA may be fully or partially deductible, depending on the individual's filing status and income level. This means that individuals can reduce their taxable income in the year they make contributions, leading to potential tax savings.

However, it is important to note that while contributions may be tax-deductible, withdrawals taken during retirement are subject to ordinary income tax. This creates a key consideration for individuals: whether to prioritize immediate tax benefits through contributions or to focus on tax-free withdrawals in retirement, as seen with Roth IRAs.

Contribution Limits

The IRS sets annual contribution limits for Traditional IRAs, which can change periodically. As of 2023, individuals under the age of 50 can contribute up to $6,500 per year, while those aged 50 and older can contribute up to $7,500, allowing for catch-up contributions. It is essential for individuals to stay informed about these limits to maximize their retirement savings potential.

Eligibility and Income Considerations

Unlike Roth IRAs, Traditional IRAs do not impose income limitations for contributions, making them accessible to a broader range of individuals. However, the ability to deduct contributions may be affected by income levels, particularly for those who are covered by an employer-sponsored retirement plan. Therefore, understanding one's eligibility and the implications of income on tax deductions is crucial when considering a Traditional IRA.

Withdrawal Rules and Required Minimum Distributions

Withdrawals from a Traditional IRA can typically begin at age 59½ without incurring penalties. However, it is important to note that individuals must start taking required minimum distributions (RMDs) by April 1 of the year following the year they turn 73. Failing to take RMDs can result in significant penalties, emphasizing the importance of planning for these distributions as part of retirement strategy.

Investment Options

Traditional IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, and other financial instruments. This flexibility allows individuals to tailor their investment strategies according to their risk tolerance and retirement goals. It is advisable for individuals to regularly review their investment choices and adjust them as necessary to align with changing market conditions and personal circumstances.

Conclusion

In summary, a Traditional IRA presents a viable option for individuals seeking to enhance their retirement savings while benefiting from tax advantages. By understanding the key features, contribution limits, eligibility criteria, and withdrawal rules associated with Traditional IRAs, individuals can make informed decisions that align with their long-term financial goals. As retirement approaches, careful planning and consideration of various retirement accounts will be essential in ensuring financial security in later years.

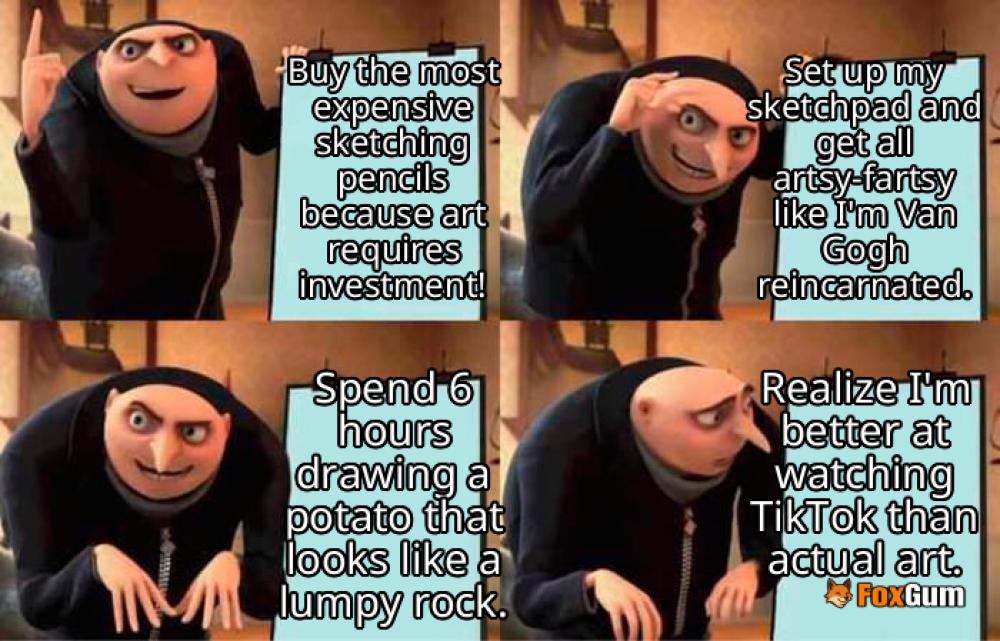

Unleash Your Inner Picasso with Sketching Pencils!

Unleash Your Inner Picasso with Sketching Pencils!

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics