Travel Benefits With Capital One Venture

Introduction

The Capital One Venture card is designed for frequent travelers seeking to maximize their rewards and benefits. This travel rewards credit card offers a variety of features that cater to the needs of travelers, making it a popular choice among those who prioritize travel experiences. This article will explore the key travel benefits associated with the Capital One Venture card, providing insights into how cardholders can leverage these advantages for their travel needs.

Key Travel Benefits

The Capital One Venture card provides several notable benefits that enhance the travel experience for its users. Below are some of the most significant advantages:

- Unlimited Miles on Purchases: Cardholders earn unlimited miles on every purchase, allowing them to accumulate rewards quickly. This feature is particularly beneficial for those who make frequent purchases, as it enables them to earn travel rewards without restrictions.

- Flexible Redemption Options: The miles earned can be redeemed for a variety of travel-related expenses, including flights, hotels, rental cars, and even ride-sharing services. This flexibility allows cardholders to tailor their rewards to their specific travel needs.

- No Blackout Dates: One of the standout features of the Capital One Venture card is the absence of blackout dates. Cardholders can book flights with any airline at any time, providing a level of convenience that is often lacking in other travel rewards programs.

- Annual Travel Credit: Eligible primary account holders receive a $300 annual travel credit that can be applied to purchases made through Capital One Travel. This benefit effectively reduces the overall cost of travel and encourages users to utilize the card for their travel bookings.

- Travel Insurance and Protections: The card offers various travel insurance benefits, including trip cancellation insurance, lost luggage reimbursement, and travel accident insurance. These protections provide peace of mind for travelers, ensuring they are covered in case of unforeseen circumstances.

- Global Acceptance: The Capital One Venture card is widely accepted around the world, making it a convenient option for international travelers. This global acceptance ensures that cardholders can use their card without worrying about currency conversion or acceptance issues.

How to Maximize Travel Benefits

To fully leverage the travel benefits offered by the Capital One Venture card, cardholders should consider the following strategies:

- Utilize the Annual Travel Credit: Ensure that the $300 travel credit is used each year to offset travel expenses. This can significantly enhance the value of the card.

- Plan Travel Around Reward Opportunities: Take advantage of promotions or special offers that may allow for increased miles on specific purchases or travel bookings.

- Combine with Other Rewards Programs: While the Venture card offers substantial rewards, combining it with other loyalty programs can further enhance travel benefits. For example, using the card for hotel stays that offer additional points can lead to greater rewards.

- Stay Informed on Changes: Regularly review the terms and conditions associated with the card, as benefits and participating properties may change. Staying informed ensures that cardholders can adapt their strategies accordingly.

Conclusion

The Capital One Venture card provides a comprehensive suite of travel benefits that cater to the needs of frequent travelers. With unlimited miles on purchases, flexible redemption options, and valuable travel protections, it stands out as a competitive choice in the travel rewards credit card market. By understanding and utilizing the various benefits effectively, cardholders can enhance their travel experiences and maximize the value of their rewards.

Jean-paul Marat French Revolution

Jean-paul Marat French Revolution

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

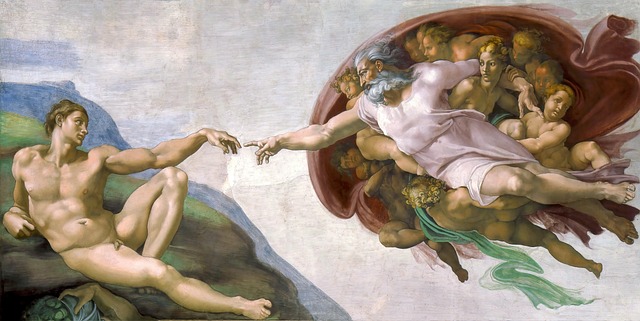

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics