Technical Analysis: A Deep Dive

Technical analysis is a fascinating approach to evaluating securities, primarily focusing on price movements and trading volume rather than the underlying financial health of a company. It’s like reading the pulse of the market, helping traders make informed decisions based on historical price patterns and trends. 📈

What is Technical Analysis?

At its core, technical analysis is about understanding market psychology. By analyzing price charts, traders can identify potential future movements based on past behavior. Unlike fundamental analysis, which evaluates a company’s value based on financial metrics like earnings and sales, technical analysis leans heavily on price action and volume. This method allows traders to generate short-term trading signals and assess the strength or weakness of a security relative to the market or its sector.

History of Technical Analysis

The roots of technical analysis can be traced back to the late 1800s with Charles Dow, who introduced the Dow Theory. This theory laid the groundwork for modern technical analysis, and over the years, notable figures like William P. Hamilton, Robert Rhea, Edson Gould, and John Magee have contributed to its development. Their work has shaped how traders interpret price movements and market trends today.

Key Components of Technical Analysis

There are several key components that make up technical analysis:

- Price Charts: The most fundamental tool in technical analysis, price charts visually represent price movements over time.

- Volume: Analyzing trading volume helps traders understand the strength behind price movements. High volume can indicate strong interest in a security.

- Indicators: Various indicators, such as moving averages and Relative Strength Index (RSI), help traders identify trends and potential reversal points.

- Patterns: Chart patterns, like head and shoulders or triangles, can signal potential future price movements based on historical behavior.

How to Use Technical Analysis

Using technical analysis effectively requires practice and a good understanding of market dynamics. Here are some steps to get started:

- Choose Your Tools: Familiarize yourself with different charting tools and indicators. This will help you develop your own trading strategy.

- Analyze Historical Data: Look at past price movements to identify trends and patterns that may repeat in the future.

- Set Entry and Exit Points: Based on your analysis, establish clear entry and exit points for your trades to manage risk effectively.

- Stay Updated: Market conditions can change rapidly, so it’s essential to keep an eye on news and events that may affect price movements.

Conclusion

Technical analysis is a valuable tool for traders looking to navigate the complexities of the market. By focusing on price and volume, it offers insights that can enhance trading strategies and decision-making. Whether you’re a beginner or an experienced trader, understanding the principles of technical analysis can help you make more informed choices in your trading journey. 🌟

The Artists Association of Nantucket

The Artists Association of Nantucket

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

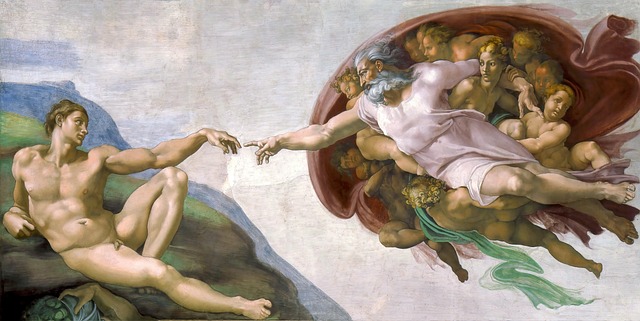

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics