Section 179 and Vehicle Weight Requirements

In 2025, small businesses looking to maximize their tax deductions will find the Section 179 provision particularly relevant. This section of the U.S. tax code allows businesses to deduct the full purchase price of qualifying vehicles, provided they meet certain criteria. One of the key requirements is that the vehicle must have a Gross Vehicle Weight Rating (GVWR) of over 6,000 pounds. This article will explore the vehicles that meet this criterion, focusing on SUVs and trucks that are popular among small business owners.

Why Choose Vehicles Over 6,000 Pounds?

Vehicles with a GVWR exceeding 6,000 pounds offer substantial tax advantages. Under Section 179, businesses can deduct the entire purchase price in the year the vehicle is placed into service, rather than depreciating it over several years. This can lead to significant tax savings, especially for businesses that rely on these vehicles for operations.

Popular 2025 Vehicles Over 6,000 Pounds

Here is a list of some popular SUVs and trucks that qualify for Section 179 in 2025:

- Ford Expedition - A full-size SUV known for its spacious interior and towing capacity.

- Chevrolet Tahoe - Another full-size SUV that offers a blend of comfort and utility, making it a favorite for families and businesses alike.

- Ram 2500 - A heavy-duty truck that provides excellent towing capabilities and a robust engine lineup.

- GMC Sierra 2500HD - Similar to the Ram 2500, this truck is designed for heavy-duty tasks and offers a comfortable ride.

- Toyota Sequoia - Known for its reliability and off-road capabilities, this SUV is suitable for both urban and rugged environments.

- Nissan Armada - A full-size SUV that combines luxury with functionality, appealing to both business and leisure users.

- Chevrolet Suburban - Renowned for its spaciousness and versatility, making it ideal for transporting larger groups or cargo.

How to Verify Vehicle Weight

To confirm that a vehicle qualifies under Section 179, it is essential to check its GVWR. This information can typically be found on the driver's side door frame. It is important to note that the listed weights are estimates and can vary based on factors such as engine size, trim level, and additional options.

Financing Options for Businesses

When considering the purchase of a vehicle over 6,000 pounds, businesses should also explore financing options. Many lenders offer specialized financing solutions tailored for commercial vehicles, which can help businesses manage cash flow while taking advantage of tax deductions. It is advisable to consult with a tax professional to understand the implications of such purchases fully.

Conclusion

For small businesses, investing in vehicles over 6,000 pounds can lead to significant tax benefits under Section 179. By understanding which vehicles qualify and how to verify their weight, businesses can make informed decisions that align with their operational needs and financial goals. As 2025 approaches, it is crucial to stay updated on any changes to tax laws that may affect these deductions.

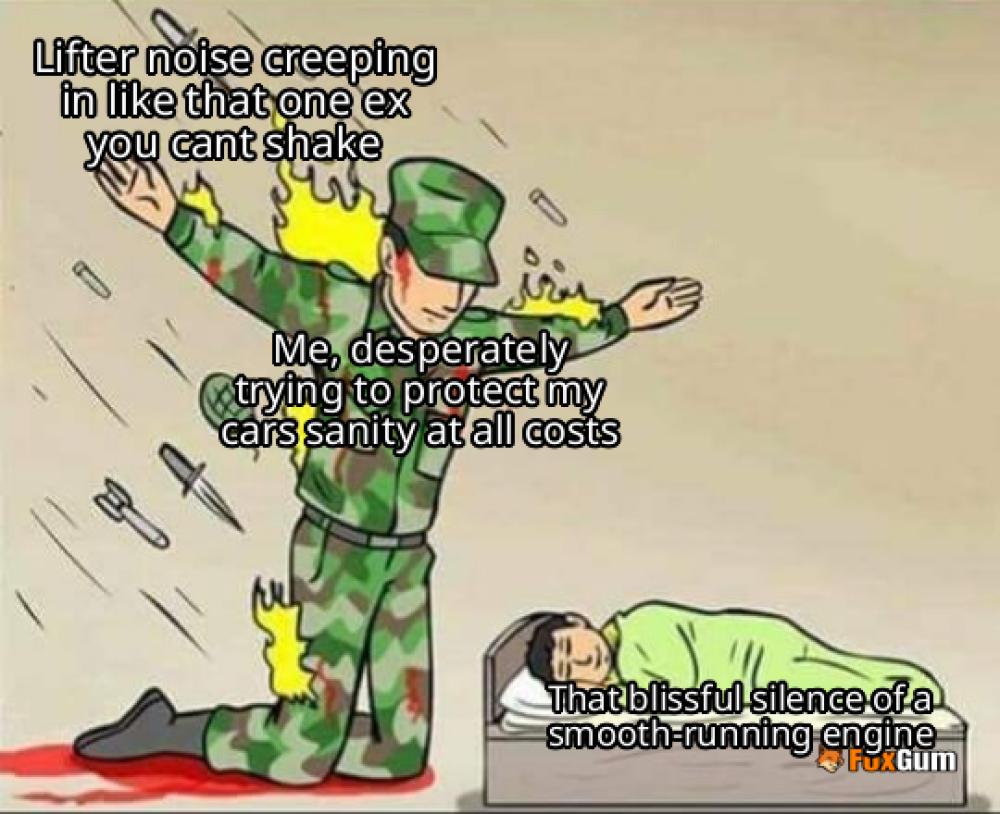

Rocker Arms

Rocker Arms

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics