Accounts Receivable Turnover

Understanding Accounts Receivable Turnover

The accounts receivable turnover ratio is a key financial metric that measures how efficiently a company collects payments from its customers. This ratio indicates how many times a business can convert its receivables into cash over a specific period, typically a year. A higher turnover ratio suggests that a company is effective in managing its receivables, while a lower ratio may indicate potential issues in collecting payments.

Calculating the Accounts Receivable Turnover Ratio

The formula for calculating the accounts receivable turnover ratio is straightforward:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

In this formula:

- Net Credit Sales refers to the total sales made on credit, excluding any returns or allowances.

- Average Accounts Receivable is calculated by adding the beginning and ending accounts receivable for the period and dividing by two.

Interpreting the Ratio

A ratio close to or above the industry average typically indicates good performance, while a significantly lower ratio may raise concerns about the company's credit policies or customer payment behaviors.

Factors Affecting Accounts Receivable Turnover

- Credit Policies: Stricter credit policies may lead to fewer sales but can improve cash flow by ensuring that customers are more likely to pay their debts.

- Customer Base: The nature of the customer base can also affect turnover. For instance, businesses that deal with larger corporations may experience slower payment cycles compared to those serving smaller businesses.

- Economic Conditions: Economic downturns can lead to delayed payments, impacting the turnover ratio negatively.

- Invoicing Practices: Efficient invoicing and follow-up processes can enhance the speed of collections, improving the turnover ratio.

Improving Accounts Receivable Turnover

- Streamline Invoicing: Ensure that invoices are sent promptly and are easy to understand. This reduces confusion and speeds up payment.

- Implement Payment Incentives: Offering discounts for early payments can encourage customers to pay sooner.

- Regular Follow-Ups: Establishing a routine for following up on outstanding invoices can help maintain cash flow.

- Review Credit Policies: Regularly assess credit policies to ensure they align with the current market conditions and customer payment behaviors.

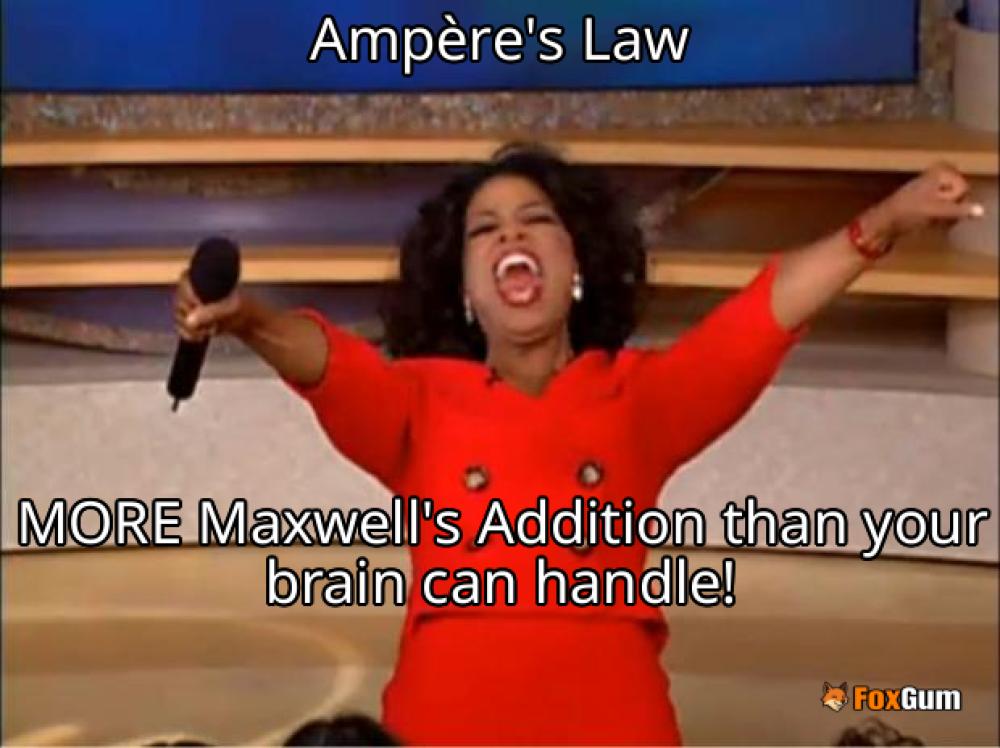

Ampère's Law With Maxwell's Addition

Ampère's Law With Maxwell's Addition

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics