Collections Debt: What You Need to Know

Ah, debt collection. The term alone can send shivers down the spine of even the most financially savvy individuals. It’s like that awkward moment at a party when someone brings up politics—nobody really wants to talk about it, but here we are. So, let’s break it down and make it a little less scary, shall we?

What is Collections Debt?

Collections debt refers to the money you owe that has been handed over to a collections agency. Think of it as that last-ditch effort by creditors to retrieve what’s rightfully theirs after you’ve ignored their calls like they’re the ex who just can’t take a hint. Once your debt is in collections, it’s usually because you’ve missed payments for a while, and your creditor decided they’ve had enough of your radio silence.

How Does Debt Collection Work?

Here’s the lowdown: when you fail to pay your debt, your creditor might decide to send it to a collections agency. This agency will then attempt to collect the debt from you. It’s like sending in the big guns, but instead of a superhero, you get a person on the other end of the phone who’s just trying to do their job. But don’t worry, there are rules in place to protect you from overly aggressive tactics.

Your Rights Under the Debt Collection Rule

As of November 30, 2021, the Debt Collection Rule became effective, clarifying how debt collectors can communicate with you. It’s like a user manual for dealing with those pesky calls. Here are some key points:

- Clear Communication: Debt collectors must provide you with specific information about the debt, including the amount owed and the name of the creditor. No more vague threats or mysterious charges!

- Ceasing Communication: If you dispute the debt, collectors are required to stop contacting you until they provide verification of the debt. So, if you’re feeling feisty, don’t hesitate to challenge them!

- Settlement Options: They are allowed to inform you of settlement options that may help you avoid further collection efforts, including foreclosure. It’s like they’re saying, “Hey, we can work together on this!”

Why You Shouldn’t Ignore Debt Collectors

Ignoring debt collectors is like ignoring a fire alarm—eventually, you’ll regret it. While it might be tempting to hide under your blanket and pretend everything is fine, facing the issue head-on is usually the best course of action. Engaging with debt collectors can help you understand your options and potentially negotiate a payment plan that works for you.

What Happens If You Don’t Pay?

If you continue to ignore the situation, things could get a bit messy. Your credit score could take a hit, and the debt could lead to legal action. Think of it as the financial version of stepping on a Lego—painful and entirely avoidable if you just pay attention.

Final Thoughts

Collections debt doesn’t have to be a nightmare. By understanding your rights and how the process works, you can navigate this tricky terrain with a little more confidence. Remember, knowledge is power, and in this case, it might just save you a few sleepless nights. So next time that phone rings, don’t run away—pick it up and face the music!

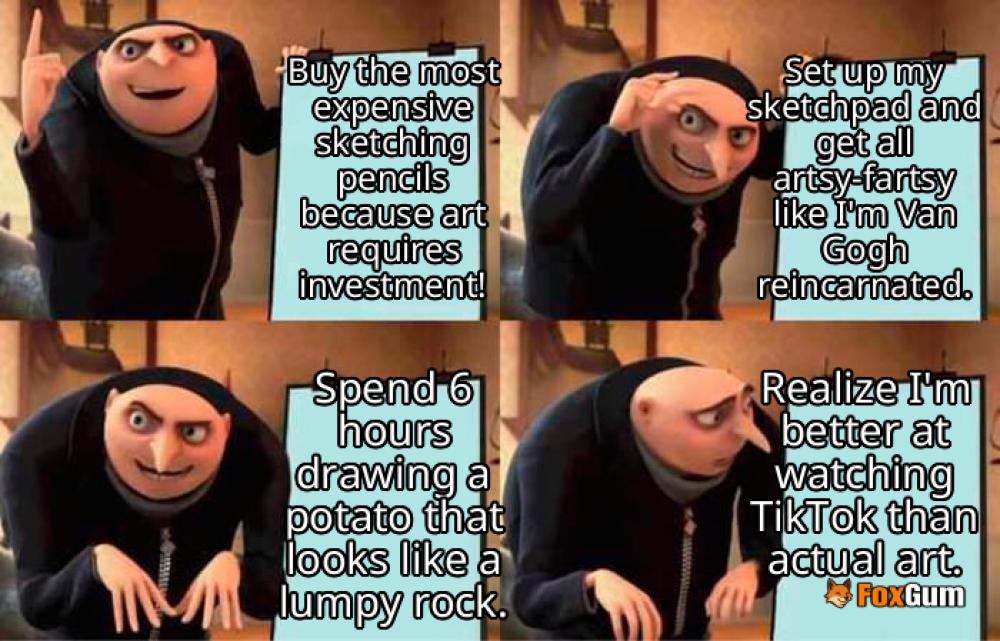

Unleash Your Inner Picasso with Sketching Pencils!

Unleash Your Inner Picasso with Sketching Pencils!

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics