The Rollercoaster of Interest Rates: What You Need to Know

Ah, interest rates. The financial equivalent of a soap opera—full of drama, unexpected twists, and the occasional cliffhanger. If you’re feeling a bit dizzy from all the ups and downs, don’t worry! This guide will help you navigate the tumultuous waters of interest rates, especially those pesky mortgage rates that seem to have a mind of their own.

Current State of Affairs

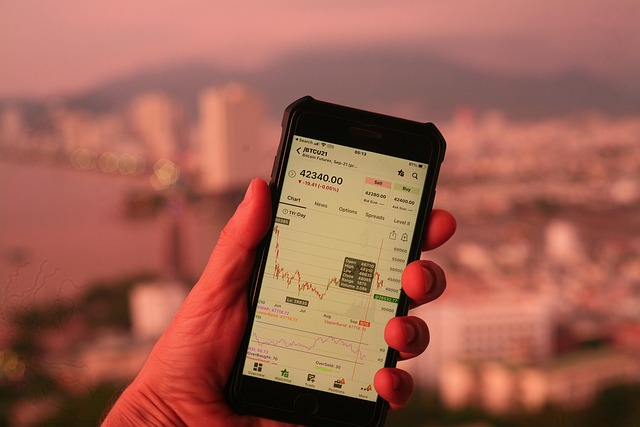

As of today, the average rate for a 30-year fixed mortgage hovers around 6.85%. It’s a tad higher than last week, which saw a slight rise of 6 basis points. But hold on to your hats, because just a few weeks ago, rates dipped below the average of 6.83%. It’s like interest rates are playing hide-and-seek, and we’re all just trying to catch a break!

Why You Should Care

So, why should you care about these fluctuating numbers? Well, if you’re in the market to buy a home or refinance an existing mortgage, these rates can significantly impact your wallet. Lower rates mean lower monthly payments, which translates to more money for that avocado toast habit (or, you know, saving for retirement—whatever floats your boat). 🥑

Refinancing: A Silver Lining?

If you’re considering refinancing, it’s good to know that the current national interest rate for a 30-year fixed refinance is 6.94%. Yes, it’s a smidge higher than the purchase rate, but it’s crucial to compare offers and see what works best for your financial situation. Sometimes, a little bit of research can lead to big savings!

How to Make Sense of It All

- Stay Informed: Keep an eye on the market trends. Rates can change weekly, sometimes daily. Subscribe to financial news outlets or follow social media accounts dedicated to finance. (Your future self will thank you!)

- Shop Around: Don’t settle for the first rate you see. Different lenders offer different rates, and you might just stumble upon a deal that makes your heart sing.

- Calculate Your Savings: Use online calculators to see how much you might save by refinancing or getting a new mortgage. It’s like a fun little math game, but with real money at stake!

- Consult a Professional: If all this seems overwhelming, consider speaking with a financial advisor. They can help you navigate the choppy waters and find the best path forward.

Final Thoughts

Interest rates may seem like a boring topic, but they have a profound impact on our financial lives. Whether you’re buying your first home or refinancing an existing mortgage, staying informed can help you make the best decisions for your future. And who knows? You might just find that navigating the world of interest rates can be a little less daunting and a lot more rewarding. 🌟

Asset Ownership Documents

Asset Ownership Documents

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics