Neobank Chime

Introduction to Chime

Chime is a financial technology company that operates as a neobank, providing a range of banking services through partnerships with traditional banks. Unlike conventional banks, Chime does not hold a banking charter; instead, it offers its services through The Bancorp Bank, N.A. This model allows Chime to deliver a variety of financial products without the overhead costs associated with traditional banking institutions.

Key Features of Chime

Chime has gained popularity for its user-friendly mobile banking platform and several attractive features:

- Early Access to Paychecks: Chime users can receive their paychecks up to two days early when they set up direct deposit, providing quicker access to funds.

- No Overdraft Fees: Chime allows negative account balances without charging overdraft fees, which can be a significant relief for users managing tight budgets.

- High-Yield Savings Accounts: Chime offers a high-yield savings account option, allowing users to earn interest on their savings, which is often higher than traditional banks.

- Peer-to-Peer Payments: Users can easily send and receive money from friends and family through Chime’s app, making it convenient for everyday transactions.

- Interest-Free Secured Credit Card: Chime provides an interest-free secured credit card that helps users build their credit score without incurring additional interest charges.

Security Measures

Security is a critical concern for any financial service, and Chime takes this seriously. The company employs secure processes to protect user information and prevent unauthorized access. Users can feel confident knowing that their funds are safeguarded through the partnerships with chartered banks, which also provide FDIC insurance for customer deposits.

Customer Support

Chime offers 24/7 customer support to assist users with any inquiries or issues they may encounter. Support is available through multiple channels, including phone, in-app messaging, and a comprehensive Help Center. This accessibility is a notable advantage for users who may need immediate assistance.

Conclusion

Chime represents a modern approach to banking, appealing to those who prefer digital solutions over traditional banking methods. With features designed to enhance user experience and financial management, it caters to a diverse audience, particularly younger consumers and those seeking alternatives to conventional banking. As the landscape of financial services continues to evolve, Chime stands out as a notable player in the neobanking sector.

Nominees Luncheon

Nominees Luncheon

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

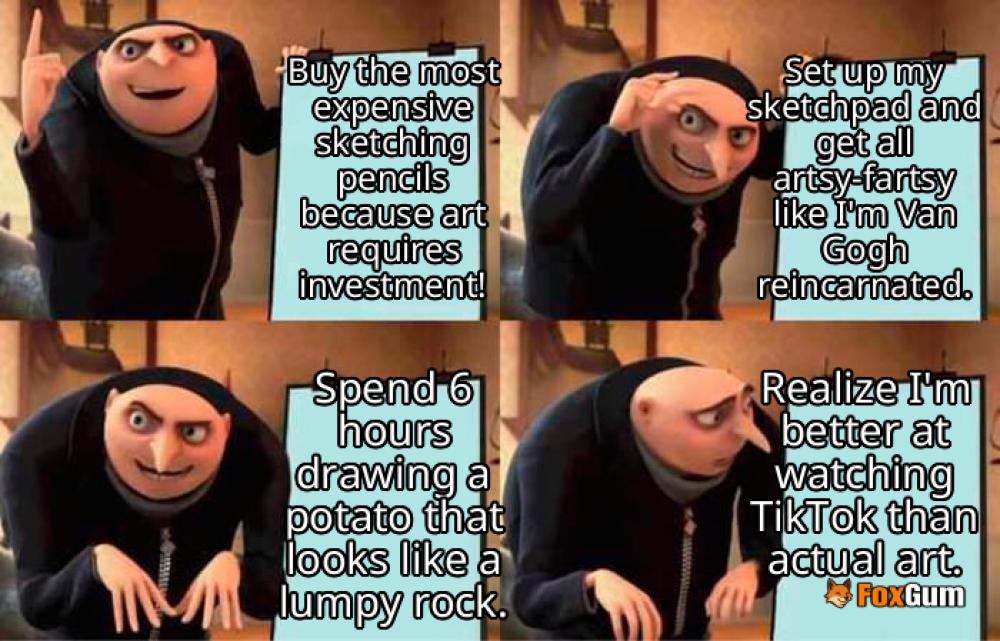

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

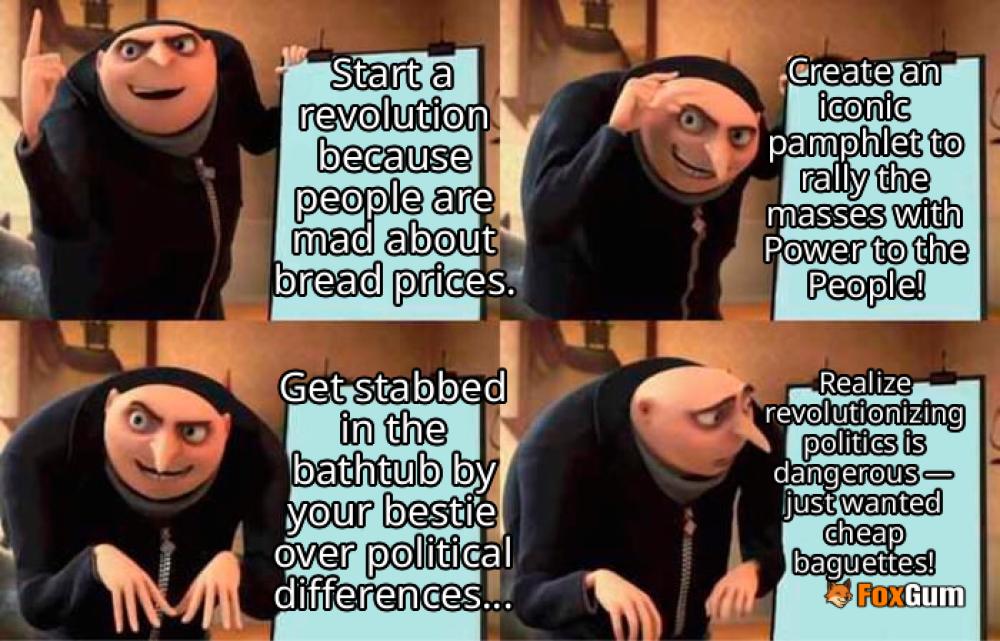

Gadgets  Politics

Politics