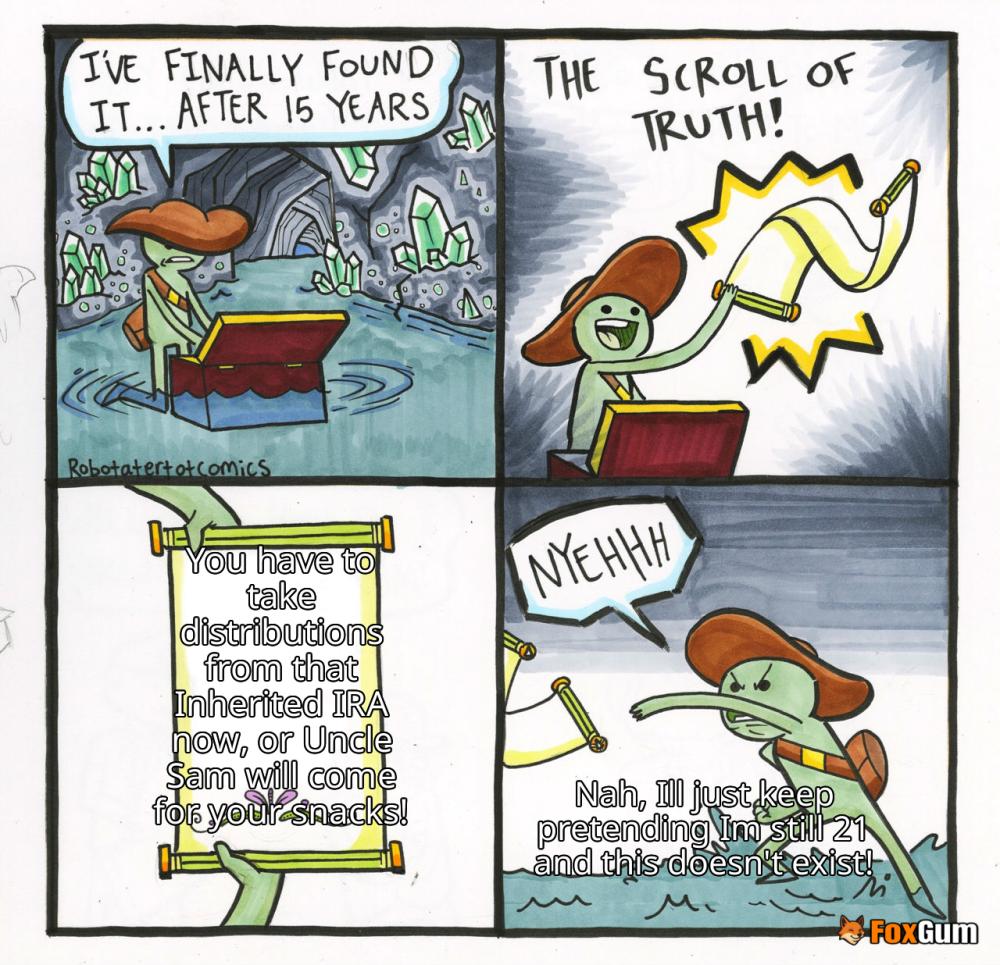

Cashing Out An Inherited IRA: What You Need to Know

So, you’ve just inherited an IRA, and you’re probably thinking, “Cha-ching! Time to cash out and splurge on that dream vacation!” 🌴✈️ Hold your horses, though! Before you start picking out your beachwear, let’s break down the nitty-gritty of what cashing out an inherited IRA really means.

Understanding the Basics

First things first: an Inherited IRA isn’t your typical retirement account. It’s a special kind of account that comes with its own set of rules, especially if the original account holder kicked the bucket after 2019. Thanks to the SECURE Act, there are a few things you need to keep in mind. 🧐

The SECURE Act and Its Impact

If your loved one passed away after December 31, 2019, the SECURE Act dictates that you might have to take annual distributions regardless of your age. Yep, that means you can’t just let it sit there like an old couch in your garage! 🛋️

- Annual Distributions: You may need to withdraw a portion of the funds every year. This is like a mandatory “let’s keep the money moving” rule.

- Full Distribution: In some cases, you might have to withdraw all the funds within a specific time frame (usually 10 years). So, don’t get too comfy with that cash! 💸

However, if the account holder passed away before 2020, you’re in a different ballpark. You’ll have more flexible options, but it’s still crucial to know your limits and requirements.

What Are Your Options?

When it comes to cashing out, you’ve got a couple of paths to choose from:

- Take the Money and Run: You can cash out entirely, but be prepared to pay taxes on the amount. Uncle Sam always gets his cut! 💰

- Roll It Over: If you want to keep things chill and avoid immediate taxes, consider rolling it over into your own IRA. This gives you more control and time to decide what to do with it.

Remember, it’s not just about what you want to do with the money; understanding the tax implications is key! 📊

Final Thoughts

Inheriting an IRA can feel like winning the lottery, but it’s crucial to play it smart. Whether you choose to cash out, roll over, or take annual distributions, make sure you’re informed about the rules and regulations that apply to your situation. You don’t want to end up in a pickle because you didn’t read the fine print! 🥒

So, before you book that trip to Bali or splurge on that shiny new gadget, take a moment to assess your options and consult with a financial advisor. Your future self will thank you! 🙌

Egg-laying Mammals

Egg-laying Mammals

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics