The RSI Indicator

The Relative Strength Index (RSI) is a popular technical indicator that traders use to gauge the momentum of a security's price movements. Developed by J. Welles Wilder Jr., this tool helps identify overbought or oversold conditions in the market, making it a staple for many traders. But how does it work, and how can you use it effectively? Let’s dive in!

What is the RSI?

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically displayed as a line graph. The key levels to watch are 70 and 30. When the RSI is above 70, it indicates that a security might be overbought, while a reading below 30 suggests it could be oversold. 📈

How to Interpret the RSI

Understanding the RSI readings is crucial for making informed trading decisions. Here’s a breakdown:

- Overbought Condition: An RSI above 70 suggests that the security may be overbought, indicating a potential price correction. This doesn’t mean you should sell immediately; rather, it’s a signal to watch for a possible reversal.

- Oversold Condition: Conversely, an RSI below 30 indicates that the security may be oversold. This could present a buying opportunity, but it’s essential to confirm with other indicators before acting.

- Trend Reversals: The RSI can also signal potential trend reversals. If the RSI starts to diverge from the price action, it might indicate that the current trend is losing strength.

Best Practices for Using the RSI

While the RSI is a powerful tool, it’s most effective when used in conjunction with other analysis methods. Here are some best practices:

- Combine with Other Indicators: Use the RSI alongside other indicators like moving averages or MACD to confirm signals.

- Watch for Divergence: If the price is making new highs while the RSI is not, it could signal a potential reversal.

- Consider Market Conditions: The RSI works best in range-bound markets rather than trending markets. Be cautious when using it in strong trends.

Limitations of the RSI

No indicator is perfect, and the RSI has its limitations. It can remain in the overbought or oversold territory for extended periods, especially during strong trends. Thus, relying solely on the RSI can lead to premature decisions. Always consider the broader market context! 🌍

Conclusion

The RSI is a valuable tool for traders looking to understand market momentum and identify potential entry and exit points. By combining it with other indicators and being mindful of market conditions, traders can enhance their decision-making process. Happy trading!

Casebook Pbc: A Game-Changer in Human Services Software

Casebook Pbc: A Game-Changer in Human Services Software

Health

Health  Fitness

Fitness  Lifestyle

Lifestyle  Tech

Tech  Travel

Travel  Food

Food  Education

Education  Parenting

Parenting  Career & Work

Career & Work  Hobbies

Hobbies  Wellness

Wellness  Beauty

Beauty  Cars

Cars  Art

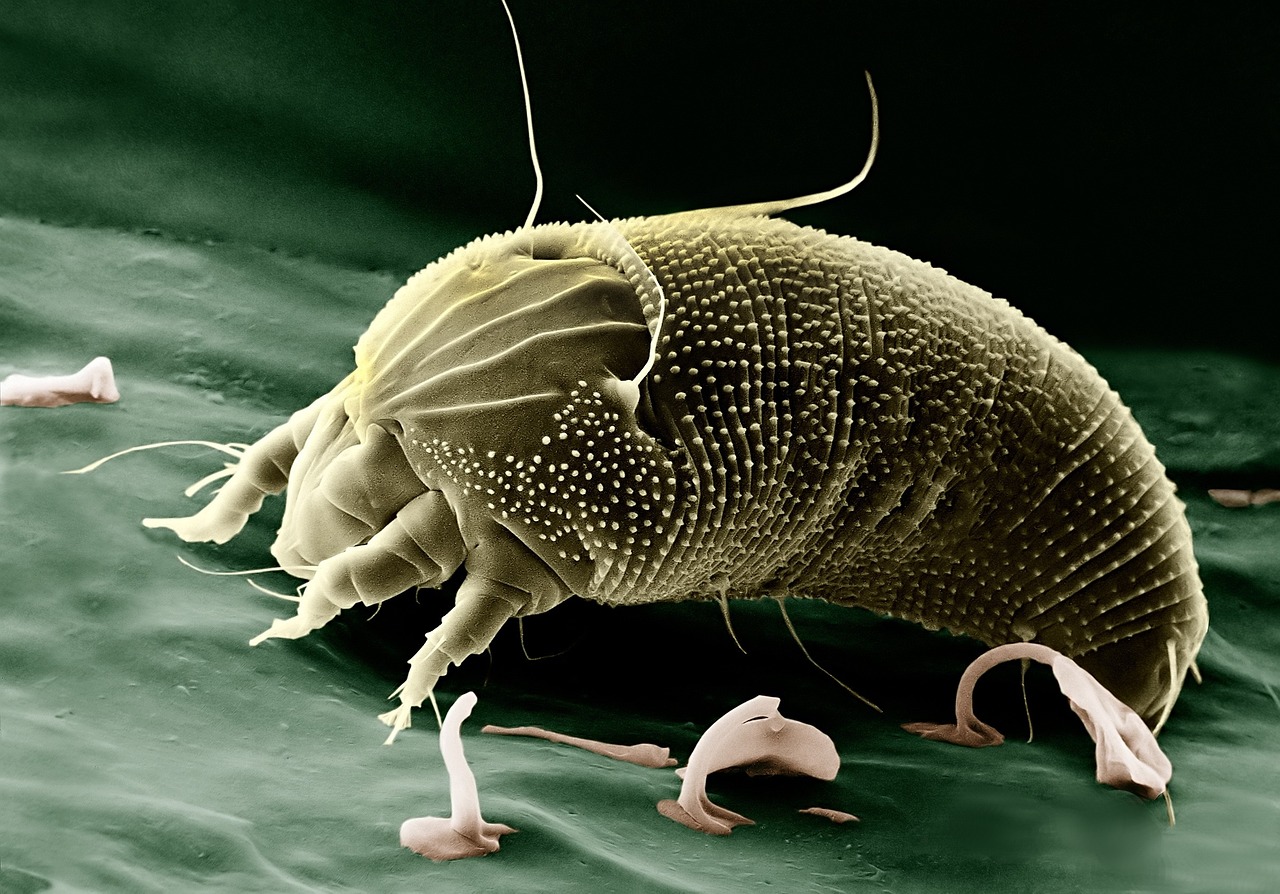

Art  Science

Science  Culture

Culture  Books

Books  Music

Music  Movies

Movies  Gaming

Gaming  Sports

Sports  Nature

Nature  Home & Garden

Home & Garden  Business & Finance

Business & Finance  Relationships

Relationships  Pets

Pets  Shopping

Shopping  Mindset & Inspiration

Mindset & Inspiration  Environment

Environment  Gadgets

Gadgets  Politics

Politics